Rivian (RIVN) will report fourth-quarter earnings Thursday after the market closes. Though the EV maker aggressively minimize prices final 12 months, a provide scarcity derailed some momentum. Rivian nonetheless stands by its objective of attaining its first constructive gross revenue in This fall. Right here’s what to anticipate from the report.

Rivian expects a constructive gross revenue in This fall 2024 earnings

Rivian beat expectations with 14,183 autos delivered within the closing three months of 2024, bringing the annual whole to 51,579.

Though it was sufficient for Rivian to satisfy its full-year steering of fifty,500 and 52,000, it was solely barely greater than the 50,122 the corporate delivered in 2023.

After a provide scarcity started within the third quarter, Rivian minimize its full-year manufacturing goal to 47,000 to 49,000 autos in 2024, down from 57,000. Rivian topped its (revised) goal with 49,476 items produced at its Regular, IL plant final 12 months.

Rivian’s deliveries and manufacturing embody the R1S, R1T, and electrical supply and industrial vans. Regardless of the slower-than-expected development final 12 months, the corporate nonetheless expects earnings to enhance.

Final month, the EV maker confirmed that “The beforehand mentioned scarcity of a shared element on the R1 and RCV platforms is now not a constraint” on manufacturing.

| Q1 2024 | Q2 2024 | Q3 2024 | This fall 2024 | Full-12 months 2024 | 2024 steering | |

| Deliveries | 13,588 | 13,790 | 10,018 | 14,183 | 51,579 | 50,500 – 52,000 |

| Manufacturing | 13,980 | 9,612 | 13,157 | 12,727 | 49,476 | 47,000 – 49,000 |

Rivian additionally stated it’s nonetheless on observe to submit its first constructive gross revenue in This fall. CFO Claire McDonough informed analysts on the corporate’s third-quarter earnings name that Rivian expects “a modest gross revenue” within the closing three months of 2024.

Nonetheless, McDonough clarified that regulatory credit score gross sales, decrease prices because of plant upgrades and improved provide contracts, and different income exterior automobile gross sales would primarily drive the achievement.

| Q3 ’22 | This fall ’22 | Q1 ’23 | Q2 ’23 | Q3 ’23 | This fall ’23 | Q1 ’24 | Q2 ’24 | Q3 ’24 | |

| Rivian loss per automobile | $139,277 | $124,162 | $67,329 | $32,594 | $30,500 | $43,372 | $38,784 | $32,705 | $39,130 |

Rivian’s web loss fell to $1.1 billion within the third quarter, with a gross revenue lack of $392 million. Though the corporate misplaced round $39,000 on every automobile delivered within the third quarter, this can be a drastic enchancment from 2022, when Rivian misplaced over $139,000 per unit.

Together with a $1 billion convertible observe from Volkswagen, Rivian ended the third quarter with $6.7 billion in money and equivalents.

In line with Estimize, Wall St expects Rivian to submit This fall income of $1.4 billion, up from $1.3 billion in This fall 2023, and a lack of 0.68 per share (EPS) in comparison with a lack of $1.36 per share.

Prepping for R2

After launching its new three way partnership with VW, Scaringe stated the partnership was a “significant monetary alternative” price as much as $5.8 billion.

In line with Rivian’s Chief Software program Officer, Wassym Bensaid, different OEMs are actually “knocking on our door” about related provide offers for EV tech and software program.

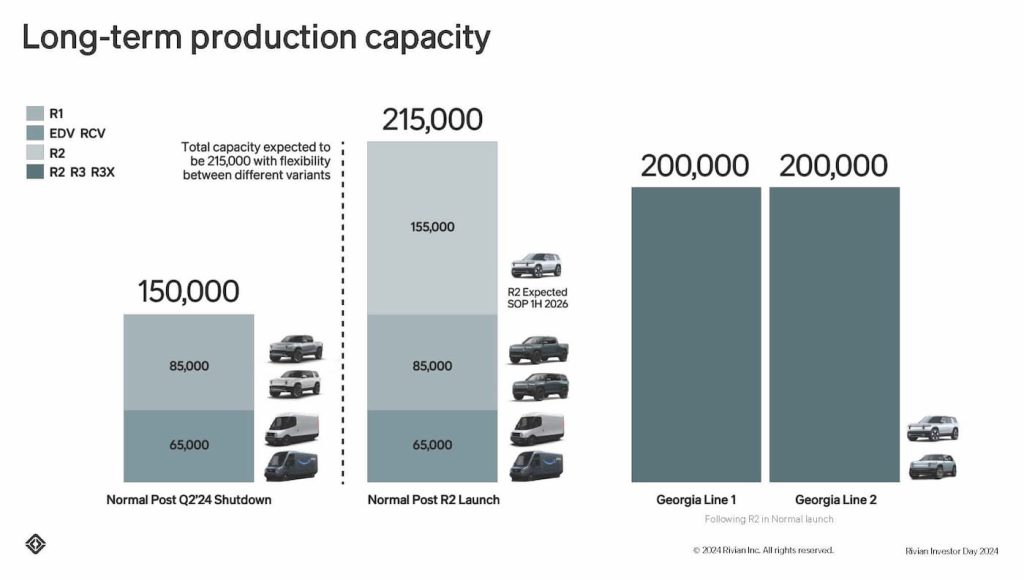

Rivian’s largest development driver continues to be but to return. The corporate is getting ready to launch its mid-size electrical SUV, the R2, early subsequent 12 months. It’s going to initially be constructed at Rivian’s Regular, IL facility, however manufacturing is anticipated to considerably increase with plans to open a second plant in Georgia.

The R2 will begin at round $45,000, or almost half the price of the present R1T ($71,700) and R1S ($77,700). Rivian can even construct a smaller, extra reasonably priced R3 crossover and high-performance R3X on the Georgia facility.

Rivian plans to construct the plant in two phases, every including 200,000 items of annual manufacturing capability. Rivian says the R2 and R3 are “crucial drivers within the firm’s long-term development and profitability.”

Though Rivian secured a $6.6 billion federal mortgage for the brand new EV plant simply earlier than Trump took workplace, the funding is now in jeopardy after the Administration introduced plans to freeze federal loans.

Georgia Gov Brian Kemp informed Channel 2 information this week that Rivian “secured that mortgage on the tail finish of the Biden administration and, you recognize, I feel there’s no secret that the Trump administration is looking in any respect these issues.” He added, “So I don’t actually know the place that stands proper now.”

Rivian is assured the funds might be there subsequent 12 months once they go to attract them. A spokesperson stated, “We’re working arduous to onshore US manufacturing, offering hundreds of American jobs right here in Georgia.”

Rivian’s inventory is up since reporting third-quarter earnings in November. Nonetheless, RIVN shares are nonetheless down 12% over the previous 12 months and 90% from their all-time excessive shortly after going public in November 2021.

Examine again tomorrow after the market closes for a full breakdown of Rivian’s This fall 2024 earnings report.

FTC: We use revenue incomes auto affiliate hyperlinks. Extra.